The Essence of Investment

At its core, investing is like planting a seed. You start with something small—your initial capital—and with time and proper care, it grows into something much larger. The investor (you) provides resources (money) to help an asset grow, with the expectation of harvesting greater returns in the future.

Just as a plant needs time to develop from seed to tree, investments need time to mature and generate meaningful returns. Patience is key in the investment process, as the most significant growth often happens in later stages.

Types of Investments

The investment world offers various vehicles for growing your wealth, each with distinct characteristics:

Real Estate

Physical property investments that can generate rental income and appreciate in value over time. These tangible assets provide both potential income and growth.

Stocks

Ownership shares in companies that allow you to participate in their growth and profits. When you own stock, you literally own a piece of that business.

Bonds

Loans to governments or corporations that pay you interest over time. These are generally more stable than stocks but offer lower potential returns.

Commodities

Physical goods like gold, silver, or agricultural products that can serve as a hedge against inflation and economic uncertainty.

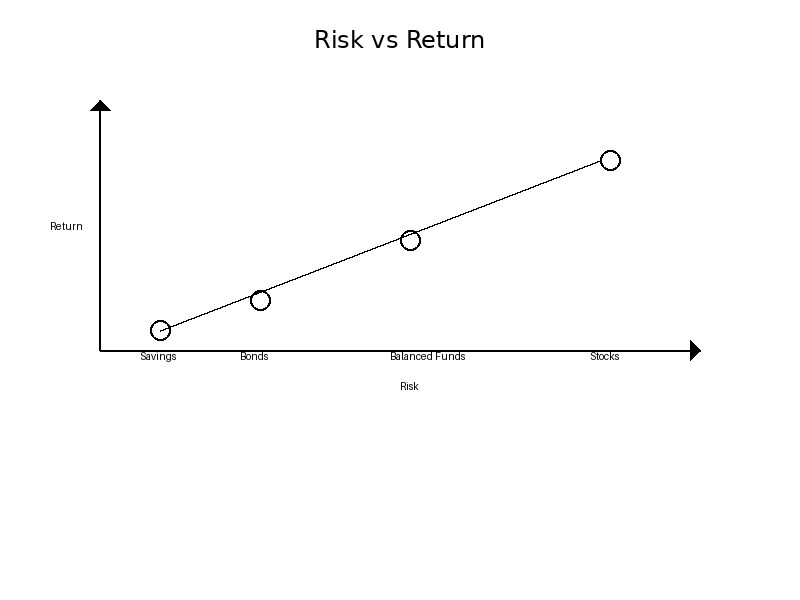

Risk vs Return

The fundamental relationship in investing is that between risk and return. Generally, the higher the potential return of an investment, the higher the risk involved.

Low-risk investments like savings accounts offer security but minimal returns. As you move up the risk spectrum through bonds and balanced funds to stocks, the potential returns increase—but so does the possibility of losing money.

Understanding your own risk tolerance is crucial for building an investment portfolio that lets you sleep at night while still working toward your financial goals.

Diversification

The old saying "Don't put all your eggs in one basket" perfectly captures the essence of diversification. By spreading your investments across different asset types, industries, and geographic regions, you reduce the impact of any single investment performing poorly.

A diversified portfolio might contain a mix of stocks, bonds, real estate, and perhaps some alternative investments. When one area struggles, others may perform well, helping to smooth out your overall returns and reduce volatility.

Diversification doesn't guarantee profits or protect against all losses, but it's one of the most powerful risk management tools available to investors.

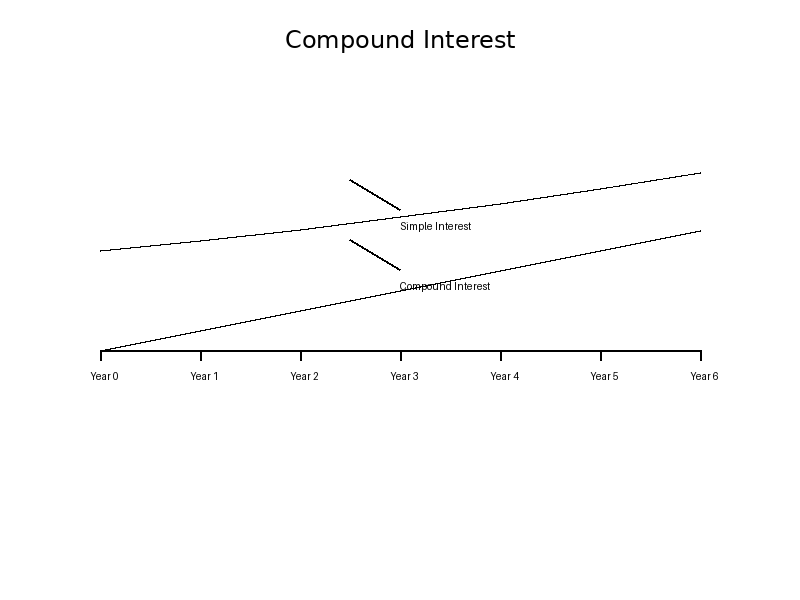

Compound Interest

Albert Einstein reportedly called compound interest "the eighth wonder of the world," and for good reason. It's the process by which your investment returns themselves generate additional returns over time.

Unlike simple interest, which only earns returns on your principal investment, compound interest earns returns on both your principal and previously accumulated interest. This creates an accelerating growth curve that becomes more powerful the longer your money remains invested.

The magic of compounding explains why starting to invest early—even with small amounts—can lead to significantly larger outcomes than waiting and investing larger sums later.

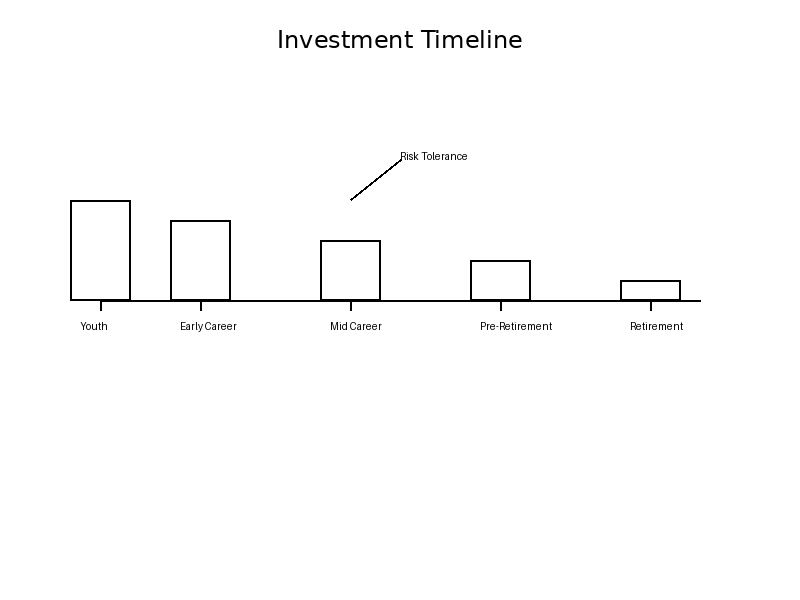

Investment Timeline

Your approach to investing naturally evolves throughout your life as your goals, time horizon, and risk tolerance change.

In your youth and early career, with decades until retirement, you can generally afford to take more risk, focusing on growth-oriented investments like stocks. The longer time horizon allows you to weather market volatility and benefit from compound growth.

As you progress through mid-career and approach retirement, gradually shifting toward more conservative investments helps protect the wealth you've accumulated. By retirement, your portfolio typically emphasizes income generation and capital preservation rather than aggressive growth.

This lifecycle approach to investing aligns your investment strategy with your changing needs and circumstances over time.

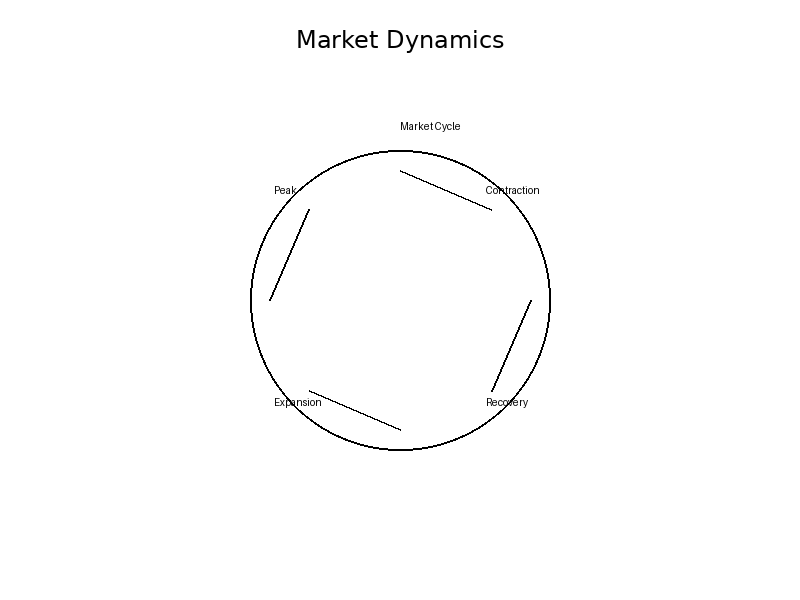

Market Dynamics

Financial markets move in cycles, alternating between periods of expansion and contraction. Understanding these cycles can help you maintain perspective during market volatility.

The typical market cycle includes four phases:

Recovery

The market begins to rebound from its lows, though economic indicators may still appear weak.

Expansion

Economic growth accelerates, corporate profits rise, and investor optimism increases.

Peak

The market reaches its highest point in the cycle, often accompanied by excessive optimism.

Contraction

Economic growth slows, corporate profits decline, and market prices fall.

Successful long-term investors recognize that these cycles are natural and inevitable. Rather than trying to time the market perfectly, they maintain a disciplined approach through all market conditions.